We are committed to guiding businesses and individuals through the complexities of finance with confidence and clarity. Backed by years of expertise in financial planning, investment management, and business consulting, we deliver solutions that inspire trust and drive success.

Our seasoned team provides dependable insights and strategies, empowering you to make well-informed, secure financial decisions with confidence.

We specialize in creating personalized solutions designed to meet your unique financial needs, helping you achieve your goals and turn aspirations into reality.

With a proven track record of delivering impactful results, we are proud to showcase our history of successful outcomes and long-standing client satisfaction.

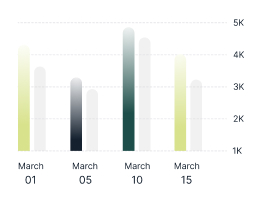

active user

To provide personalized financial solutions that empower individuals and businesses to achieve their goals, making every financial decision a step toward sustained prosperity.

To be the trusted partner in financial growth, delivering innovative solutions that transform challenges into opportunities for success in an ever-evolving financial landscape.

Discover how strategic planning and intelligent financial decisions can pave the way to long-term success. Gain key insights and access powerful tools to grow, manage, and protect your wealth effectively.

Learn how our proven financial process guides you step-by-step toward achieving your financial goals. From personalized planning to strategic execution.

project complete

years experience

satisfied client

Our team comprises seasoned professionals with extensive.

Improve cash flow structured savings budgeting techniques

Stay on track with your financial goals through regular check-ins

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today's finance landscape, making it easier to navigate your financial journey.

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.

The first credit card ever issued was made of cardboard and was introduced.

we believe that you should keep more of what you earn.